10 Simple ways to Save Money in your Everyday Life

1. Shop with a cash-back credit card.

You might be surprised by the savings when you choose the right card with the right benefits. Inflation means not only higher prices but higher interest rates on your credit cards. If you don’t already have a cashback card, check out these websites - CreditCards.com, WalletHub, or NerdWallet, and compare rewards cards.

2. Cancel subscriptions you aren't using.

When was the last time you looked at your subscription costs? Are you using them all? Cancel those that you don’t use or don’t really need.

3. Minimize restaurant spending.

You can cut your food budget in half by cooking at home. You may need to start by organizing your pantry. Throw away expired items and arrange packages and containers for easy access. Stay away from recipes that require exotic ingredients that you will only use once, that’s a waste of money. Stick to the basics and buy in bulk when you can.

4. Share to Save.

If you’re already a member of Impact HealthSharing then you know how much sharing costs can save you money. Impact members save on average $500 a month! You can also share memberships with friends and split the costs. Offer dog-sitting or babysitting trades with those you trust.

5. Keep your eye on the prize.

One of the best ways to save money is to set a goal. Saving can be easy and exciting at first, but after a while you may lose that initial motivation and start to find other things you can spend that money on. To avoid veering off course, check in with your goals regularly and keep your eye on the prize.

6. Look for extra cash lying around in your budget.

You should know your budget and understand where your money is going. Have you adjusted your budget with all the increases in the cost of living this year? Look for outgoing cash that you can reduce and instead invest in your goals and contribute to savings.

7. Plan out your meals for the week.

Once you start learning to look at your food as a “number of meals,” you’re on your way to meal planning. The key is to figure out how much food you need to buy to make it until your next grocery trip to avoid those once-a-week quick stops that end up costing you $100. Once you can do that, you’ll find yourself ordering emergency takeout much less often.

8. Wait 48 hours before you click "buy."

One way to avoid overspending is to give yourself a cooling-off period between the time an item catches your eye and when you actually make the purchase. For some, it’s 48 hours, but for others, it may be longer. Be aware of that trigger finger.

9. Deal with your emotions.

Excessive spending is often a way to avoid feeling certain emotions. Emotional spending commonly stems from five main emotions — jealousy, guilt, fear, sadness, or achievement. Having a weekly self-care night at home could be the perfect alternative to emotional spending.

10. Read a personal finance book.

You can always learn more strategies to help you save money for your goals in life by reading personal finance books or listening to financial help podcasts.-1.webp?width=795&height=530&name=Blog%20Images%20-%20Impact%20(8)-1.webp)

Here are a few apps that will help you save money. Check out each one and choose the one (or two!) that fits your needs best.

Digit: Best for optimizing savings decisions

Chime: Best for effortless savings

Acorns: Best for novice investors

Qoins: Best for those with debt

Personal Capital: Best for those needing organization

Always make time to review your budget and check your progress every month. That will help you not only stick to your personal savings plan, but also identify and fix problems quickly.

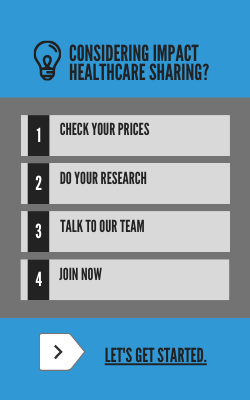

If you haven’t joined Impact now is a great time to check out the amount you could be saving monthly. Most people join for the savings but stay because of the care. See pricing options here.