Smart Financial Moves: Mastering Realistic Goal Setting for 2025

%20(900%20x%20900%20px)%20(950%20x%20700%20px)%20(2)-1.webp?width=950&height=700&name=blogImages%20-%20Impact%20(1200%20x%20630%20px)%20(900%20x%20900%20px)%20(950%20x%20700%20px)%20(2)-1.webp)

Key Highlights

- Setting realistic financial goals is essential for financial success in 2025 and beyond.

- Differentiating between dreams and achievable targets is crucial for staying motivated and on track.

- Breaking down larger goals into smaller, actionable steps helps make progress feel manageable.

- Utilizing tools and resources, such as budgeting apps and financial calculators, can aid in effective goal planning.

- Addressing unexpected expenses and adjusting goals as needed ensures you stay adaptable throughout the year.

Introduction

As 2025 gets closer, you should focus on your financial health and create a clear vision for your money. This urgency comes from knowing that reaching financial success needs a proactive plan. This blog post will help you set realistic financial goals. It will empower you to make better financial choices.

Understanding the Importance of Realistic Financial Goals

Picture this: you have big financial goals, but month after month, you fall short. This issue often comes from making unrealistic goals that don’t have a clear way to achieve them. This can lead to frustration and make you feel like a failure. Eventually, it could cause you to give up completely.

That's why it is important to set realistic financial goals. It means breaking your dreams into smaller, manageable steps. These steps will help you reach bigger successes over time. By making sure your goals are achievable, you raise your chances of success. This boost in success can increase your confidence and motivation.

The Difference Between Dreams and Achievable Financial Targets

Having big financial dreams is great, but it's important to know the difference between a dream and a clear vision of a realistic financial goal. Your dreams are like stars that guide you. Your goals are the practical steps to get there.

For example, "being financially independent" is a dream. It's a wonderful goal, but it doesn't say how to get there. A specific goal could be: "Make an emergency fund of $5,000 in the next year." This goal is clear, measurable, and has a time limit. It shows exactly what you need to do.

By making a list of goals that include clear financial targets, you create a plan to turn those big dreams into reality.

%20(900%20x%20900%20px)%20(950%20x%20700%20px)%20(1)-2.webp?width=950&height=700&name=blogImages%20-%20Impact%20(1200%20x%20630%20px)%20(900%20x%20900%20px)%20(950%20x%20700%20px)%20(1)-2.webp)

Why Setting Ambitious Yet Attainable Goals Matters for Financial Health

Setting big goals is important to help you improve your finances. Even if those goals take hard work and dedication, they push you forward. If you aim too low, you may not grow and might feel stuck.

When you set tough but reachable goals, you help yourself step out of your comfort zone. This can give you better chances of success. It encourages you to try new ideas and build strong money habits. In the end, you will feel better about your finances.

Keep in mind that setting financial goals is not just a one-time thing. It is a way of continuous improvement. Check your progress often. Change your goals if necessary. Don’t forget to celebrate the milestones you reach along the way!

Preparing to Set Your Financial Goals for 2025

Before you set specific goals, it's a good idea to build a strong base for success. This means collecting the right resources and knowing where you stand financially.

Just like building a house needs a plan, reaching your financial goals needs a clear strategy. Take the time to get the tools and information you need. This will help you work toward your financial success.

Essential Tools and Resources for Effective Goal Planning

Luckily, we live in a time with many resources to help with financial planning. There are budgeting apps and online calculators. These tools can be very helpful for reaching your goals.

Here are some popular resources to think about:

- Budgeting Apps: Apps like Mint, YNAB (You Need a Budget), and Personal Capital have great tracking features. They can help you see how you spend money and find ways to do better.

- Financial Calculators: You can find online calculators on trusted finance websites. They help with calculations for paying off debt, saving goals, and investment plans.

- Goal-Setting Worksheets: There are many printable or digital worksheets made to help you plan your goals.

By using James Clear's ideas on "atomic habits," try to make small changes using these tools. Being consistent is very important for building good financial habits.

Identifying Your Financial Baseline: Where to Start?

To have a clear vision of your financial goals, you need to know where you are starting. This means understanding your financial baseline. Your baseline includes your income, expenses, assets, and debts.

Start by tracking your income and expenses for one or two months. Look at how you spend money and find places to cut costs. Next, make a list of your assets. This can include savings accounts, retirement funds, and any property you own. Finally, figure out your total debt. This includes credit card balances, student loans, and mortgages.

When you know the full picture of your finances, you can set realistic milestones. You can also create a timeframe to reach them. Remember, making big financial changes takes time. Be patient and focus on small, steady steps.

A Step-by-Step Guide to Setting Realistic Financial Goals

%20(900%20x%20900%20px)%20(950%20x%20700%20px)%20(3)-1.webp?width=950&height=700&name=blogImages%20-%20Impact%20(1200%20x%20630%20px)%20(900%20x%20900%20px)%20(950%20x%20700%20px)%20(3)-1.webp)

Now that you know more about your financial situation and the resources you have, it's time to set your goals. Keep in mind that being clear is very important when you define your goals.

This simple guide will give you a clear plan to help make your financial dreams come true.

Step 1: Define What Financial Success Looks Like for You

Financial success is not the same for everyone; it is very personal. Before you set your work goals, take time to think about what financial success means to you. Does it mean owning a home? Having independence with money? Or traveling the world?

Once you have a clear vision of your main goals, you can set milestones that match your values and dreams. These milestones act as checkpoints on your financial path. They give you motivation and a feeling of success as you move forward.

For example, if your main goal is to retire early, a milestone could be: "Max out my retirement contributions by age 40." By defining what financial success looks like for you and breaking it down into smaller milestones, you make a clear roadmap for reaching your financial dreams.

Step 2: Break Down Your Goals Into Actionable Steps

Having set your goals now is the time to divide them into smaller steps that are easier to handle. This method gives you more clarity and makes things feel less stressful. Also, setting a timeframe for each step creates structure and adds a sense of urgency.

For example, if your aim is to make a budget and follow it, here are some steps you can take:

- Week 1: Track all your income and expenses.

- Week 2: Sort your spending and find areas where you can cut back.

- Week 3: Pick a budgeting method that fits your needs and preferences.

By splitting larger goals into smaller, actionable steps and assigning a timeframe for each, you make steady progress toward your financial goals. Remember, being consistent is very important. Small, steady actions can lead to big results over time.

Overcoming Common Setbacks in Financial Goal Setting

Life is full of surprises. Setbacks happen to everyone, especially regarding money. You might face an unexpected medical bill or lose your job suddenly. These surprises can mess up even the best money plans. The important thing is to expect possible problems and find ways to handle them.

By knowing that setbacks can happen and learning to adapt, you can deal with these issues better. This way, you can stay focused on your money goals and take care of your financial health in the long run.

Dealing with Unexpected Expenses Without Derailing Your Plans

Unexpected expenses happen to everyone. A car repair, a medical bill, or a problem at home can upset your plans for spending. The best way to deal with these issues is to focus on two things: planning ahead and adjusting when needed.

Start an "emergency fund." This is a savings account just for sudden costs. Having this fund can help you avoid debt when surprises come your way.

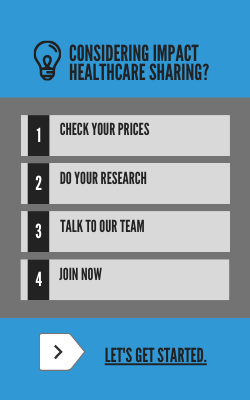

Look at these situations as chances to improve your life. You can learn new skills and find different ways to earn money. There are also many resources that can help you manage your money better when it comes to medical bills, such as Impact Health Sharing.

Adjusting Your Goals as Your Financial Situation Evolves

Just like your life changes, your financial goals can change too. You might get a promotion, have a new family member, or choose a different job. These changes can greatly affect your money situation.

Instead of seeing these changes as problems, look at them as chances to improve. Updating your financial goals shows that you are being smart, not failing. It's an important part of keeping your finances healthy.

Think of your financial journey as a marathon, not a short race. There will be times when you need to go slower or take a different path. The important thing is to remember your long-term goals. Adjust your plans and strategies to meet your needs while staying focused on your overall financial health. Switching to healthcare sharing for 2025 can help you grow your savings. Most members report savings of up to 50%. Check out some reviews here.

Conclusion

Setting practical financial goals is very important for your money health. By knowing what targets you can reach and what are just dreams, you set yourself up for success. Take control of your money future by deciding what success looks like for you. Then, break your goals into manageable steps. Be ready for surprise costs and change your goals when needed. Look at your goals often and adjust them to keep moving forward. Remember, having too many goals can slow you down. Use helpful tools to plan well. Stay motivated and keep track of how you are doing to reach your money dreams. Start your journey to financial success today!

Frequently Asked Questions

What Are Some Examples of Realistic Financial Goals for 2025?

Some realistic financial goals could be to build an emergency fund that covers three months of expenses, pay off a specific credit card in six months, or raise your retirement contributions by a set percentage every three months. Making a list of goals with a clear vision, manageable steps, and a specific timeframe can improve your chances of success.

What's the Best Way to Track Progress Towards My Financial Goals?

The best way to manage your money is by using a budgeting app or a simple spreadsheet. You can track your income and expenses easily. Break your goals into manageable steps. Celebrate your small wins. This will help you build good financial habits.

How Can I Stay Motivated to Reach My Financial Goals?

Remember your reason for each goal. Imagine your success and celebrate the small wins you make. Take on the marathon mindset that James Clear talks about. Focus on getting better over time instead of wanting quick results. This will help increase your chances of success.

COMMENTS