Exploring Health Sharing during Medicare Open Enrollment

-Aug-12-2024-02-03-19-0448-PM.webp?width=5287&height=3525&name=blogImages%20-%20Impact%20(2)-Aug-12-2024-02-03-19-0448-PM.webp)

Key Highlights

- Medicare Open Enrollment is a crucial period for individuals to review and make necessary changes to their existing choices.

- During this period, you can switch between Original Medicare and Medicare Advantage, change Medicare Advantage plans, or enroll in a Part D prescription drug plan.

- Evaluating your current health needs and understanding the latest Medicare changes is essential to making informed decisions.

- Common mistakes during Open Enrollment include overlooking available plans and ignoring changes in coverage for prescription drugs.

- Exploring health sharing as a secondary option can provide additional protection and potential cost savings.

Introduction

The Medicare Open Enrollment period is a critical time for individuals enrolled in Medicare to assess their healthcare needs and explore available options. This annual period provides the opportunity to make changes to your existing Medicare choices, ensuring they align with your health requirements for the coming year. Understanding the intricacies of Medicare Open Enrollment is vital for maximizing your healthcare benefits.

Understanding Medicare Open Enrollment

Medicare Open Enrollment is a designated period each year when individuals can make adjustments to their existing Medicare plan and add secondary options. This period is important for reviewing your current plan and exploring alternatives to ensure you have the most appropriate choices based on your needs and budget.

During Open Enrollment, you can switch from Original Medicare to a Medicare Advantage or vice versa. You can also change from one Medicare Advantage to another, enroll in a Part D prescription drug plan, switch drug plans, or even drop your prescription drug coverage entirely.

Key Dates and Deadlines for Medicare Open Enrollment

Medicare's Open Enrollment Period follows a specific timeframe, allowing individuals ample time to review their options and make necessary changes. Understanding these dates is essential to avoid missing the opportunity to adjust your medicare health plans.

The annual enrollment period runs from October 15th to December 7th. Any changes made during this period become effective on January 1st of the following year. Missing this window could mean being locked into your current choice for the remainder of the year.

|

Medicare Open Enrollment Period |

Dates |

|

Initial Enrollment Period |

3 months before, the month of, and 3 months after your 65th birthday |

|

Annual Enrollment Period |

October 15th - December 7th |

What Changes Can Be Made During Medicare Open Enrollment Period?

Medicare Open Enrollment offers a range of options and changes you can make to tailor your choice to your specific needs. Understanding these options empowers you to make informed decisions regarding your healthcare.

During this period, you have the flexibility to switch between Original Medicare and Medicare Advantage. Original Medicare, managed by the federal government, comprises Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage, or Part C, is offered by private companies as an alternative to Original Medicare.

Additionally, you can explore different Medicare Part D prescription drug plans, which often vary in coverage formularies and costs for medications.

-Aug-12-2024-02-03-18-2688-PM.webp?width=5287&height=3525&name=blogImages%20-%20Impact%20(1)-Aug-12-2024-02-03-18-2688-PM.webp)

Evaluating Your Current Medicare Coverage

Before making any changes during Medicare Open Enrollment, you should review your current program thoroughly. Compare your existing coverage with your present healthcare needs and any anticipated medical expenses in the coming year.

Consider factors such as monthly premiums, deductibles, copayments, coverage for prescription drugs, and any additional benefits offered. It's also wise to be aware of any changes in your health status or anticipated medical needs for the following year.

Assessing Your Health Needs: Now vs. Last Year

Comparing your health needs from the previous year to your current health status is crucial when evaluating your Medicare coverage. Consider any new diagnoses, changes in medications, or anticipated medical procedures.

For instance, if you've been diagnosed with a chronic condition, you might require more comprehensive coverage than what your current option offers. Evaluate if you need additional coverage for prescription drugs, specialist visits, or specific medical treatments.

Furthermore, review the preventive services in your current program. Preventive care plays a vital role in maintaining good health, and ensuring your plan adequately covers recommended screenings and vaccinations is essential.

The Impact of New Medicare Changes on Your Coverage

Stay informed about any new changes or updates to Medicare regulations and how these modifications might affect you. Medicare plans can change annually, impacting your premiums, deductibles, and even the medications covered under your prescription drug plan.

For instance, if you have a Medicare Advantage plan, carefully review the Annual Notice of Change you should receive from your provider. This notice outlines any modifications to your costs, coverage, or provider network. Being aware of these changes will help you determine if your current plan still aligns with your needs.

Additionally, if you require significant prescription drug coverage, check for any adjustments in your drug plan's formulary or cost-sharing structure for medications and consider adding a secondary option like Impact for Seniors.

Mistakes to Avoid During Medicare Open Enrollment

Navigating Medicare Open Enrollment requires careful consideration to avoid common pitfalls. One mistake is overlooking available Medicare Advantage plans. These plans often provide additional benefits and lower costs compared to Original Medicare, making them worth exploring.

Another error is neglecting to review and compare Part D prescription drug plans. Failing to do so could result in higher costs for your medications or inadequate coverage if your needs have changed.

Overlooking Available Medicare Advantage Plans

During Medicare Open Enrollment, it's easy to focus solely on your existing plan and miss out on potentially better options. Avoid the mistake of overlooking available Medicare Advantage plans, which can offer distinct advantages over Original Medicare.

Medicare Advantage from private insurance companies bundle Part A, Part B, and often Part D coverage into a single plan. They may also include additional benefits not covered by Original Medicare, such as dental, vision, and hearing coverage.

Take the time to compare different Medicare Advantage options in your area. You might find an option that provides more comprehensive coverage, lower out-of-pocket costs, or additional benefits that better suit your needs.

Ignoring Changes in Medicare Part D (Prescription Drug Plan)

Ignoring changes in Medicare Part D during open enrollment can lead to unforeseen costs and gaps in medication coverage. Medicare Part D can alter their formularies annually, impacting the drugs covered and their costs. Failure to review and update your plan during the open enrollment period may result in higher expenses for essential prescription medications. Stay informed about changes in Part D plans to ensure continuous and cost-effective access to necessary medications.

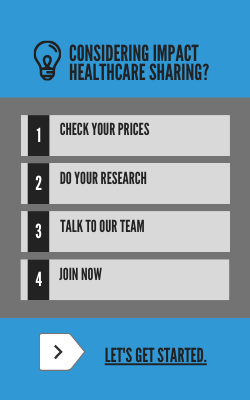

Health Sharing as a Secondary Option to Medicare

While Medicare remains the primary health insurance for individuals aged 65 and older, exploring secondary options like Impact Health Sharing can provide additional financial protection. Health-sharing ministries allow members to share the cost of healthcare expenses, offering an alternative to insurance.

Unlike health insurance, Impact is not subject to the same federal regulations and may have different eligibility requirements. However, for those seeking additional care alongside their Medicare benefits, health sharing can potentially supplement costs such as deductibles, copayments, or coinsurance.

What is Health Sharing, and How Does it Work?

Health-sharing ministries operate on the principle of members contributing to a common fund, which is then used to share eligible healthcare expenses incurred by fellow members. These organizations are typically faith-based organizations or non-profit entities.

Unlike private insurers that are subject to federal law and state mandates, health sharing ministries are governed by their specific guidelines and membership requirements. This distinction means they have more flexibility in their program offerings and can have members join outside special enrollment periods.

When a member incurs a medical expense, the ministry facilitates the sharing of those costs among its members. Members typically pay a monthly sharing amount, similar to a premium, and may have a predetermined amount they contribute towards eligible medical bills before the sharing program kicks in.

Comparing Health Sharing to Supplemental Medicare Insurance

If you're considering supplementing your Medicare plan, it's wise to compare health sharing programs to supplemental Medicare insurance, also known as Medigap. Both options provide additional care on top of Original Medicare, but they differ in their structure and regulations.

Medicare Advantage plans may be offered by private insurance companies and are considered an alternative to Original Medicare, providing Part A, Part B, and often Part D coverage in one plan. Medigap, on the other hand, is designed to work alongside Original Medicare, helping to cover costs such as copayments, coinsurance, and deductibles.

Health sharing organizations are not considered health insurance and operate under different guidelines. Choosing the right option depends on your individual needs, healthcare preferences, and budget. If you're considering a health sharing program, research thoroughly to understand its specific guidelines, limitations, and membership requirements.

-Aug-12-2024-02-03-18-3384-PM.webp?width=5287&height=3525&name=blogImages%20-%20Impact%20(3)-Aug-12-2024-02-03-18-3384-PM.webp)

How to Choose the Right Health Sharing Program

Choosing the right health sharing program requires careful consideration of various factors, including your healthcare needs, financial situation, and personal values. Not all health-sharing ministries are created equal, so conducting thorough research is essential. Start by carefully reviewing the ministry's guidelines and membership requirements. Consider downloading a comparison guide to view the differences easily.

Assess the monthly sharing amounts, any limitations, and the process for submitting and receiving reimbursement for medical expenses. Speaking with members can offer valuable insights into their experiences and overall satisfaction. Impact has member feedback available on their website here.

Factors to Consider When Selecting a Health Sharing Program

When evaluating potential health sharing programs, it's crucial to prioritize your healthcare needs and compare options carefully. Just as you would with insurance companies, review the program's details for essential medical services, particularly those you anticipate needing or utilizing frequently.

Health sharing ministries may have specific guidelines or waiting periods for pre-existing conditions. Understanding these limitations is crucial in determining if the program aligns with your healthcare needs.

Healthcare sharing ministries might have restrictions for certain medical procedures, prescription drugs, or mental health services. Carefully review the guidelines or speak with a representative to clarify any limitations before making a decision.

Benefits of Combining Health Sharing with Medicare

While Medicare provides coverage for individuals aged 65 and older, there may be gaps or out-of-pocket costs that could strain your finances. Combining health sharing with your existing Medicare choice can offer additional protection, as it did for Marilyn and her husband. Check out her Impact Health Sharing Medicare testimonial here.

Healthcare sharing can act as a secondary layer of care, assisting with costs that Medicare might not fully cover, such as deductibles, coinsurance, or copayments. For example, if you require hospitalization, health-sharing contributions from fellow members could help offset the cost, reducing your financial burden.

Understanding the key dates, assessing your health needs, and avoiding common mistakes are crucial steps to making informed decisions during this period. Healthcare sharing offers a unique approach to healthcare options, but it's essential to compare and select the right program that aligns with your specific requirements. By combining health sharing with Medicare, you can tailor them to suit your evolving health needs effectively. Make the most of this opportunity to optimize your healthcare coverage options and ensure comprehensive protection for the upcoming year.

Frequently Asked Questions

What is the Medicare Open Enrollment Period?

The Medicare Open Enrollment Period also called the annual enrollment period, occurs each year from October 15th to December 7th. This period is for those already enrolled in Medicare to make changes to their coverage, such as switching choices or enrolling in a Medicare Advantage program.

Can I switch from Medicare Advantage to Original Medicare during open enrollment?

Yes, during the Medicare Open Enrollment Period, you have the option to switch from a Medicare Advantage back to Original Medicare (Part A and Part B). You can also make this change during the Medicare Advantage Open Enrollment Period from January 1st to March 31st each year.

-Aug-12-2024-02-03-18-3384-PM.webp?width=300&name=blogImages%20-%20Impact%20(3)-Aug-12-2024-02-03-18-3384-PM.webp)